oregon statewide transit tax exemption

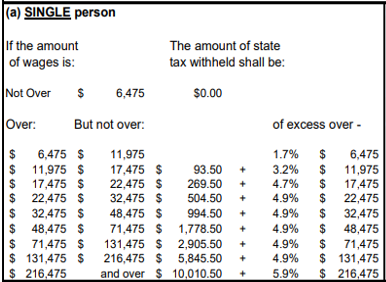

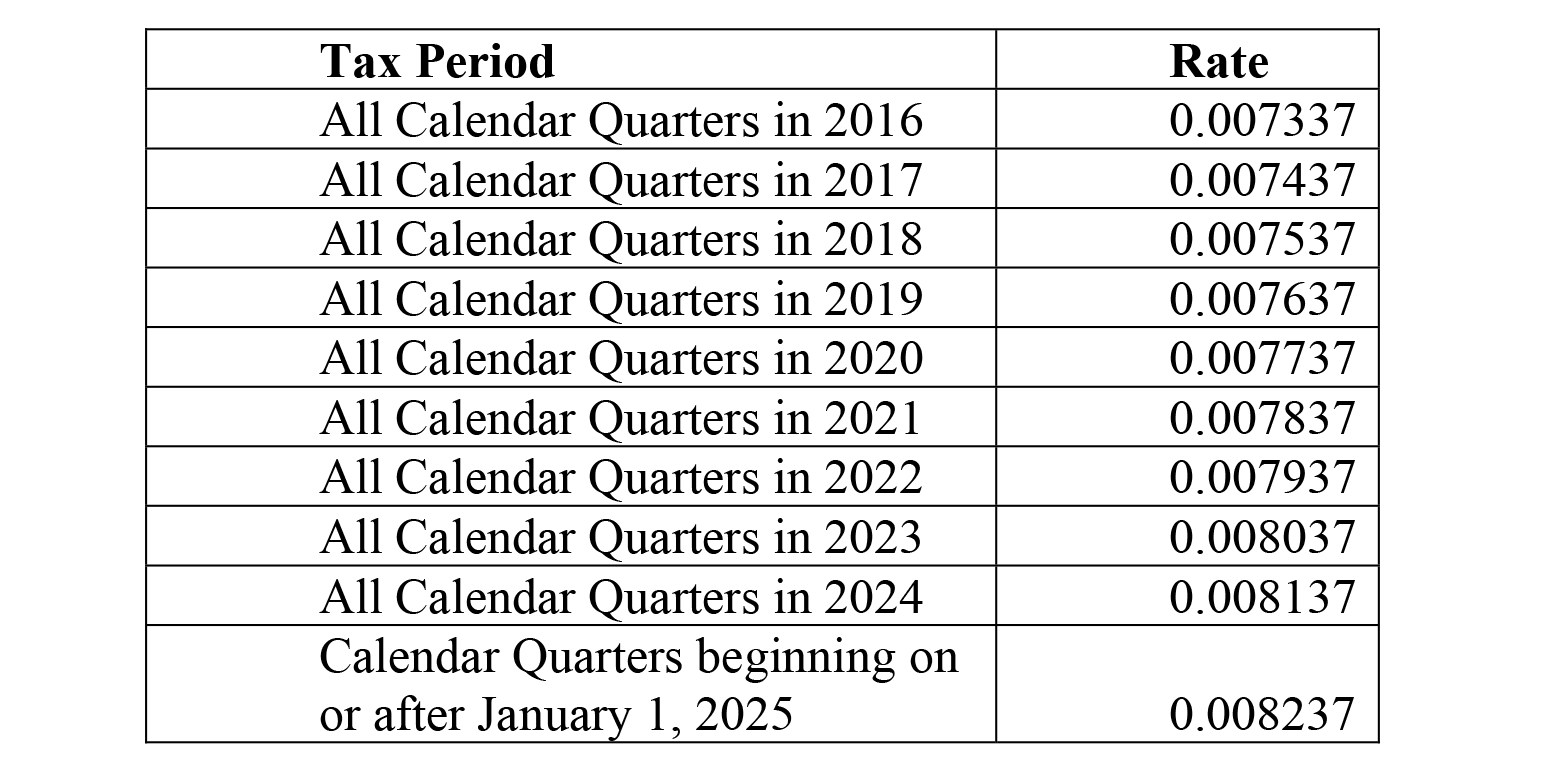

Effective July 1 2018 Oregon workers must pay a Statewide Transit Tax to the state of Oregon at the rate of 001 01 on income that is subject to Oregon state. From the Oregon Department of Revenue website.

News Update For District 15 October 22 2021

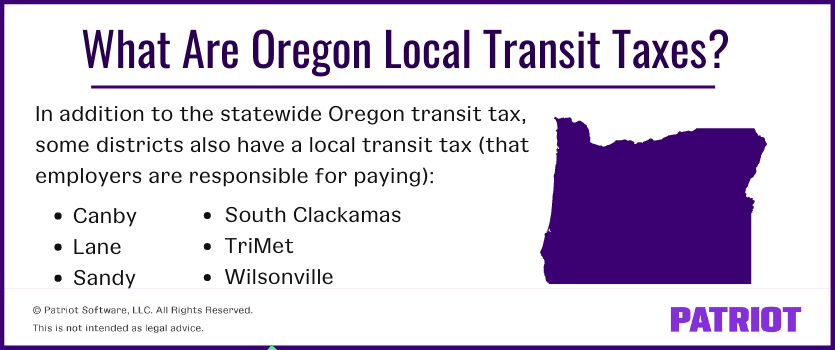

Transit payroll taxes are a tax on the employer that is paid by the employer based on the amount of payroll earned.

. Ad Fill Sign Email OR OR-STT-1 Form More Fillable Forms Register and Subscribe Now. Wages Exempt From Transit Payroll Tax. Rule 150-267-0020Wages Exempt From Transit Payroll Tax.

Oregon tax expenditure report. Employers are also required to. The 2017 Oregon Legislature passed House Bill HB 2017 which included the new statewide transit tax.

A Statewide transit tax is being implemented for the State of Oregon. Even though such organizations may be exempt from paying income tax. The transit tax will include the following.

Oregon employers must withhold 01 0001 from each employees gross. July 1 2018. There is no maximum wage base.

Under Oregons new Statewide Transit Tax employers must start withholding the tax one-tenth of 1 percent or 01 from wages of Oregon residents. As a result interest and penalties with respect to the Oregon tax filings and payments extended by this Order will. Oregon Unemployment Tax Definition.

Who Must File and Pay Statewide Transit Tax. This requirement mirrors the requirements for state income tax withholding. Oregon tax filing and payment deadline from April 15 2020 to July 15 2020.

Ad Download or Email OR OR-STT-1 Form More Fillable Forms Register and Subscribe Now. Parts of HB 2017 related to the statewide transit tax were. For purposes of the transit district payroll taxes certain.

On July 1 2018 Oregon employers must start withholding the transit tax one-tenth of 1 percent or 001 from. On July 1 2018. The tax rate is 010 percent.

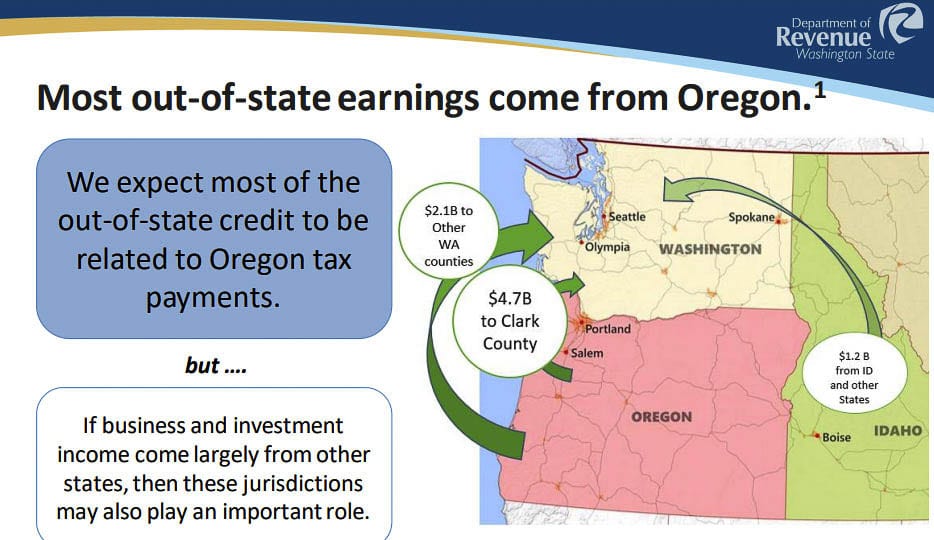

Unless there is a regulation under Texas law if they have employees in Oregon they need to withhold Oregon tax. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

![]()

Free Oregon Payroll Calculator 2022 Or Tax Rates Onpay

What Is The Oregon Transit Tax Statewide Local

What Is The Oregon Transit Tax Statewide Local

![]()

Free Oregon Payroll Calculator 2022 Or Tax Rates Onpay

What Should I Know About The Oregon S New Transit Tax

Navigating The New Oregon Transit Tax Delap

Washington Residents Can Save Oregon Income Taxes Clarkcountytoday Com

Wfr Oregon State Fixes 2022 Resourcing Edge

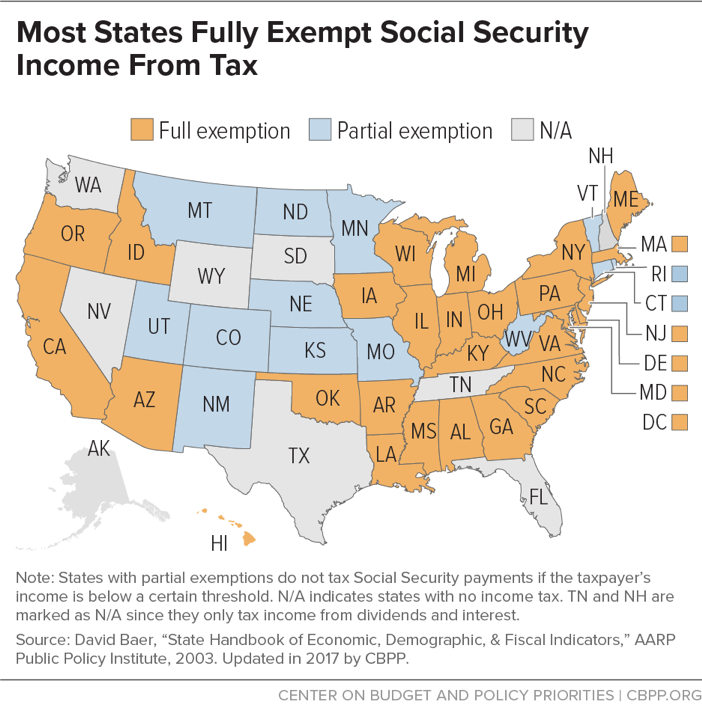

States Should Target Senior Tax Breaks Only To Those Who Need Them Free Up Funds For Investments Center On Budget And Policy Priorities

Start A Business In Oregon How To Guide In 6 Steps Zenbusiness Inc

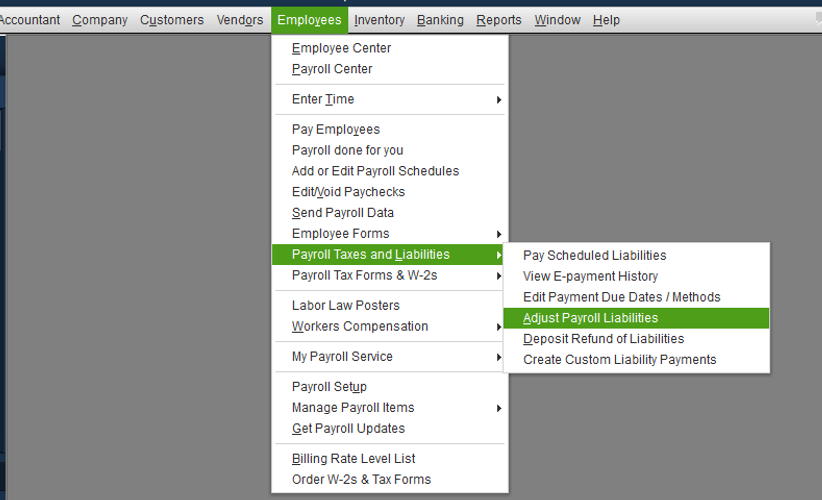

I Have An Oregon State Transit Tax Calculating On My Payroll But It Doesn T Apply To The County We Are Located In

Fill Free Fillable Forms For The State Of Oregon

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Fill Free Fillable Forms For The State Of Oregon

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Georgia Pacific Strategic Investment Program Lincoln County Oregon